If you wear or have worn a uniform, you know that people who serve can be targeted by bad actors. Tax season is no different. At PIM Tax Services, we see the same patterns year after year: crooks try to impersonate trusted institutions, promise “pennies-on-the-dollar” miracles, or pressure you into clicking before thinking. This year, a few trends are especially hot. Below are the seven scams that matter most in 2025, what they look like, why military and veteran families are disproportionately targeted, how to protect yourself, and lots of links to additional information you can use.

1) Impersonating State Tax Agencies (texts, emails, calls)

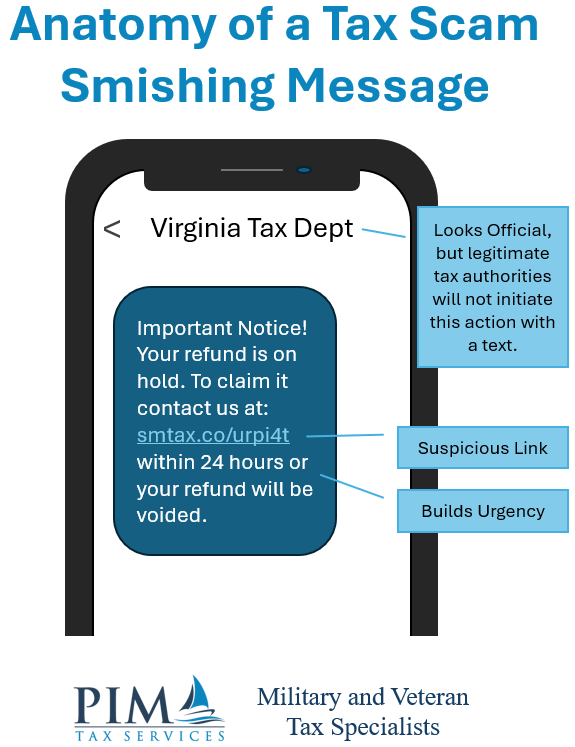

The scam. A text or email may appear to originate from a state Department of Revenue, such as “Virginia Tax,” “California FTB,” or “Georgia DOR.” It warns that your refund will be voided, or your account locked, unless you verify your account information via a link. The messages often include spoofed logos and urgent deadlines.

Why it’s effective. State agencies are less familiar to most taxpayers than the IRS, and scammers exploit that uncertainty. They also time their messages to coincide with refund cycles or notice mailings, so the message feels plausible.

What we’re seeing. Multiple states have posted fresh alerts this fall. Virginia, for example, warned in mid-September about smishing texts posing as “Virginia Tax” and pushing people to a fake payment link. (Virginia Department of Taxation Scam Alert)

How to protect yourself (fast).

- Don’t click links. Go straight to your state tax website or your secure online account to check for messages or balances.

- Treat caller ID as untrustworthy; spoofing is easy. Hang up and call the published number on the state website.

- Loop us in. We can check official channels and document everything if a report is needed.

2) Government/IRS Impersonation (phishing & phone)

The scam. Scammers still use old tricks like urgent payment demands, fake refund offers, threats of warrants, and requests for gift cards or crypto. New methods include spoofed text links and AI voice callbacks.

Why it’s effective. It weaponizes urgency and fear. The scale is enormous: government and agency impersonation continues to be a core part of the IRS’s annual “Dirty Dozen” warnings, while Americans reported a record $12.5 billion lost to fraud in 2024, according to the FTC.

Military & veteran angle. Deployments, TDYs, and frequent moves make it easy to miss a real letter and fall for a fake text. Scammers also riff on LES/VA timing and threaten your benefits or security clearance.

How to protect yourself.

- Remember: the IRS and states don’t demand gift cards, cryptocurrency, or payment via text. They also don’t threaten arrest by phone. (If you get that demand, it’s a scam.)

- Use your IRS Online Account to verify balances, notices, payment history, or to make & pay plans securely. If something looks off, contact us before you pay.

3) “Ghost” Preparers (and Other Shenanigans)

The scam. A “friend of a friend” or pop-up storefront promises bigger refunds. Fees are based on the refund amount, they won’t show you the final return. They won’t sign as the paid preparer, or they attach your signature to an e-file authorization without your consent. The “ghost” disappears when the IRS sends a notice.

Why it’s effective. People reasonably assume “a preparer is a preparer.” But legitimate paid tax return preparers sign your return and include their PTIN (Preparer Tax Identification Number). Ghosts hide because they’re inflating credits or inventing deductions and don’t want to be on the hook. The IRS’s Taxpayer Advocate has repeatedly warned about these behaviors.

How to protect yourself.

- Insist on transparency. You should see (and keep) a complete copy of the filed return and signed e-file authorization.

- Verify the PTIN. A real preparer signs and includes it; walk away from anyone who won’t. Local news and IRS reminders make this point every season.

- Beware of the Fee Structure. The IRS’s Circular 230 prohibits paid preparers from basing their fee on the size of the refund. If your tax return fee is based on the refund, be very cautious.

4) Offer-in-Compromise (“Pennies on the Dollar”) Mills

The scam. Some advertisements state they can significantly reduce IRS debt for a small percentage of the total amount, though an initial fee is required. Many of these ‘mills’ enroll people who don’t qualify, file sloppy applications, or abandon clients when the IRS rejects the offer.

Why it’s effective. Debt + fear + a government acronym (“OIC”) sounds official. But the IRS has flagged these “mills” repeatedly: aggressive marketing, false guarantees, and big fees with little to show for it.

How to protect yourself.

- Use official tools. The IRS has guidance on eligibility and installment alternatives; they’ll walk you through options that fit your actual case. (No one can “guarantee” acceptance.)

- Reality check first. Qualification depends on your income, expenses, assets, and reasonable collection potential. Run the numbers before anyone files or pays.

5) DFAS/myPay, VA & TRICARE Impersonation (benefits-related lures)

The scam. Phishers mimic DFAS/myPay, VA debt/overpayment letters, or TRICARE For Life texts (“coverage expiring – call now”). The goal: harvest your credentials, bank info, or get you to pay a fake debt.

Why it’s effective. Military families are used to official acronyms and time-sensitive tasks. Documents referencing W-2s, LES, overpayments, or coverage deadlines may seem routine, but they can have significant financial consequences if not addressed promptly.

What we’re seeing.

- VA warns of bogus overpayment notices sent by text, email, or phone; scammers even use official letterhead.

- TRICARE flagged a specific phishing text to TFL beneficiaries telling them coverage will expire due to “nonpayment” and to call a toll-free number.

- The FTC has reminded servicemembers that DFAS/myPay does not send live links in emails and that caller ID is not proof of legitimacy.

How to protect yourself.

- Never use the link or number in a message. Manually navigate to VA.gov, DFAS.mil/myPay, or TRICARE.mil and check your account.

6) Identity-Theft Refund Fraud (stolen SSNs)

The scam. A criminal files a return using your SSN before you do, claiming a refund that never reaches you. This situation frequently occurs following data breaches or when W-2/1099 information is redirected due to payroll scams.

Why it’s effective. Tax systems are designed to pay legitimate refunds quickly. Fraudsters exploit that speed and the predictable timeline of tax seasons.

Your best defense: the IRS IP PIN. An Identity Protection PIN is a six-digit code the IRS adds to your profile; the IRS will reject any return filed without that PIN. It’s free and now broadly available to most taxpayers who can verify their identity. Enroll once and the IRS issues a new PIN each year.

How to protect yourself.

- Enroll you (and your dependents) in the IP PIN program. Keep track of your PIN and keep it private. Share it only with the IRS and your tax preparer.

- File early once your documents are complete, especially if you’ve had prior identity-theft indicators.

- Keep your documents safe. Use the PIM Portal’s two-factor authentication for document exchange, not email attachments.

7) Fake Charities (often “veterans”-themed, especially after disasters)

The scam. A crisis hits, headlines surge, and so do donation requests. Some are legitimate; others copy logos, use emotional stories, and demand gift cards or crypto to “support veterans now.”

Why it’s effective. Our community wants to give – especially to fellow servicemembers and vets. Scammers exploit that generosity and then your contribution disappears because the “charity” was just a scam.

How to protect yourself.

- Verify the organization in the IRS Tax-Exempt Organization Search (TEOS) before you give. TEOS confirms eligibility for tax-deductible contributions and shows if status has been revoked.

- Be skeptical of urgent appeals demanding gift cards or crypto; real charities don’t operate that way.

- Keep proper records (receipts, acknowledgments) so we can substantiate your deduction at tax time. The IRS pages on charitable contributions and reliance on TEOS lay out the rules.

Why Military & Veteran Households Are Prime Targets

- Mobility & dispersed paperwork. PCS cycles, deployments, and multi-state moves create windows where you might miss a real letter – so a fake text feels more urgent and timely.

- Acronym overload. DFAS, VA, TRICARE, myPay – scammers borrow our language to bypass your skepticism.

- Higher credential value. A single set of stolen credentials can unlock pay, benefits, and tax profiles.

- Scale of the problem. Government figures show fraud losses hitting new highs, not because more people report, but because a larger share of victims lose money when targeted. That means today’s scams are both more convincing and more costly.

The PIM 4-Step Response Plan (Keep This Handy)

Step 1: Pause & Preserve. Don’t click or pay. Screenshot texts/emails (show headers if possible), save the phone number, and keep any envelopes.

Step 2: Verify independently.

- IRS items: check your IRS Online Account to confirm balances, recent payments, or new notices

- State items: If available, log into your state tax portal (e.g., “Virginia Tax” account) rather than using links in messages.

Step 3: If You’re a Client, Contact us. We’ll:

- Validate notices through official channels and transcripts.

- Document the incident for potential identity-theft affidavits.

- Advise on credit freezes/monitoring and whether to enroll in IP PINs now.

Step 4: Report it. Depending on the scam, report to the state DOR, IRS phishing mailbox, VA/TRICARE hotlines, the FTC, or IC3. Reporting helps cut off the next wave and might protect another military or veteran family.

Quick Red Flags (If You See It, Treat It as a Scam)

- Payment instructions via gift cards, crypto, or Zelle to resolve a tax/benefits “debt.” (The IRS and states don’t do that.)

- Live links in emails/texts claiming to be DFAS/myPay or VA/TRICARE demanding immediate action. (Navigate manually; do not click.)

- Preparers who won’t sign your return, won’t show their PTIN, or base their fee on your refund amount.

- Guaranteed OIC settlements or “we settle every case.” (No one can guarantee acceptance.)

- Charity pitches that pressure you to give now via gift card/crypto and won’t provide an EIN you can check in TEOS.

Bottom Line

Scammers evolve, so our defenses must, too. In 2025, the biggest risks we see for military and veteran families are look-alike agency messages, phony “helpers,” and pressure-based pitches that short-circuit your judgment. The antidote is simple but powerful: verify independently, use official accounts, lock down identity with IP PINs, and lean on your PIM team before you click, pay, or respond.

If something feels off, drop it in your PIM Tax Portal and ping us. We’ll check it against the official record, protect your identity, and keep your tax life calm so you can stay focused on the mission.