Military personnel who pay taxes in Virginia often overlook a very helpful tax benefit afforded by the Virginia tax code. It is called the Military Basic Pay Subtraction. It doesn’t apply to everyone, but thanks to a ruling by the Virginia Tax Commissioner, it applies to a much larger segment of the military population than is commonly thought.

As a guy who prepares a lot of tax returns every year I appreciate that Virginia closely follows the federal model for computing adjusted gross income (AGI). To get to your Virginia adjusted gross income you start with your federal adjusted gross income and then apply a handful of Virginia-specific rules for adding to or subtracting from the federal AGI to determine your Virginia AGI. I like that Virginia uses the term ‘subtractions’ to identify the things that can be subtracted from your federal AGI. Nice, simple, clean language. So rare in the tax business!

The Subtraction’s the Thing

One of the subtractions you can apply under Virginia’s tax laws is the Military Basic Pay Subtraction. Using this subtraction, military personnel can subtract up to $15,000 of their basic pay received during the taxable year, provided they were on active duty for more than 90 consecutive days.

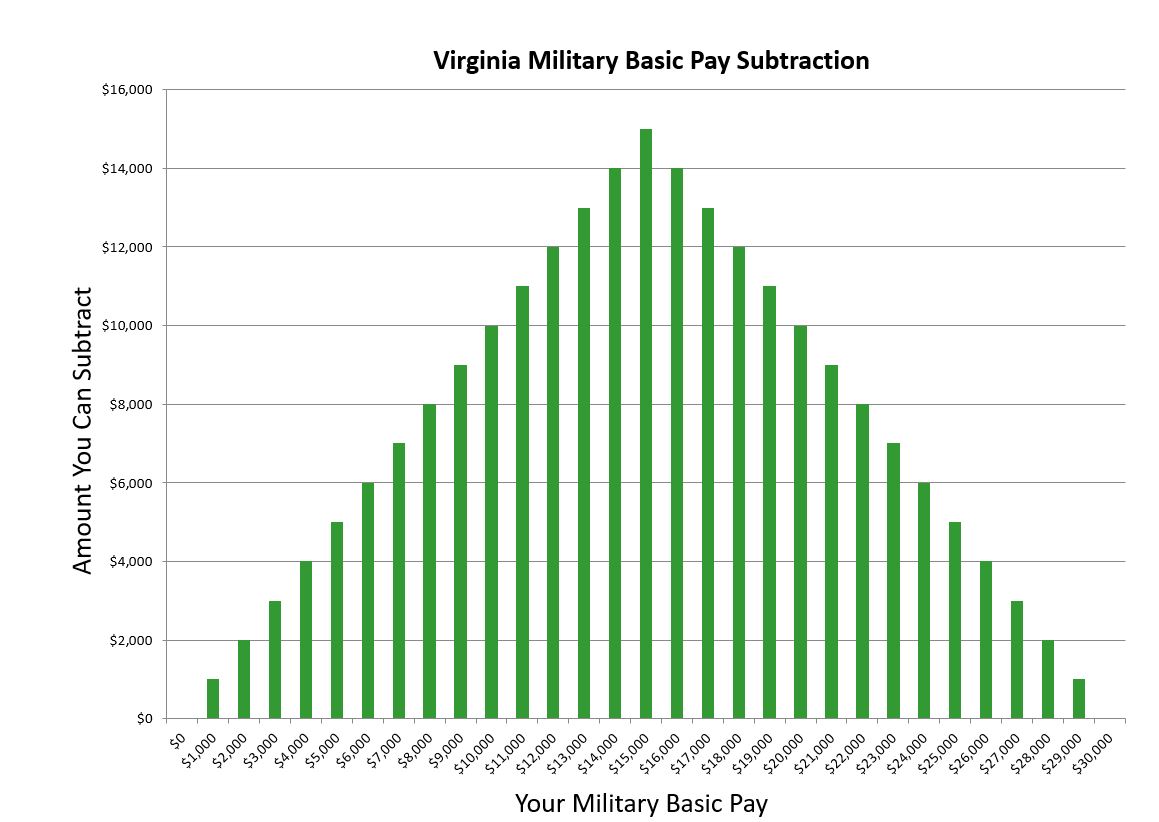

Note that “up to $15,000” part. You only get the full $15,000 if you made exactly $15,000 in basic pay. Here’s why – you can subtract every dollar of basic pay you earn up to $15,000, but once you go over $15,000 you reduce the maximum subtraction by a dollar for every dollar you are over $15,000. In other words, if you earn $15,001 of basic pay, you get a $14,999 subtraction on your Virginia tax return. If you earned $20,000 of basic pay, you get a $10,000 subtraction. At $30,000 the benefit of the subtraction is completely gone.

Looking at the military basic pay charts for 2017 it appears only very junior enlisted personnel earn less than $30,000 per year in basic pay. This limits this Virginia tax benefit to a small (although highly deserving) portion of the military population if they are on active duty and collecting basic pay for the entire year.

Fortunately, the law does not stipulate that you have to earn basic pay for the entire year. This opens up the potential for a benefit to people who enter active duty during the year, people who leave active duty during the year, and reservists. Let’s look at some examples:

1. Master Chief Grit (a Virginia resident) retires at the end of February 2017. He earned $14,230 of military basic pay in 2017. All $14,230 could be subtracted on his Virginia income tax return.

2. Master Chief Grit and his spouse, Chief Grit, (both Virginia residents) both retire at the end of February 2017. Master Chief Grit earned $14,230 of military basic pay in 2017. Chief Grit earned $9,133 of military basic pay in 2017. Even if they jointly file their 2017 Virginia income tax return they can subtract all $23,363 of their combined military basic pay. Virginia allows each spouse to qualify for (and claim) the subtraction separately on joint returns.

3. Sergeant Hammer (a Virginia resident) decides to return to the Marine Corps after several years as a civilian. He goes back on active duty on 01 July 2017. From July – December he earns $19,282 in military basic pay. He can subtract $10,718 ($15,000 – ($19,282 – $15,000)) from his 2017 Virginia income tax return.

4. Captain Junker (a Virginia resident) is a USAFR officer who does a six month tour of active duty from September 1, 2016 until March 1, 2017. In January and February 2017, he earns $11,882, all of which can be subtracted from his 2017 Virginia income tax return. (He may have also qualified for a Military Basic Pay Subtraction in 2016.)

Something important to note in that last example is that Captain Junker was not on active duty for 90 consecutive days in 2017, but he still qualifies for the subtraction. The Virginia Tax Commissioner ruled last year that the 90 consecutive days of active duty time can cross over multiple tax years and the taxpayer will still qualify for the Military Basic Pay Subtraction in an individual tax year.

It’s a nifty way to lower your Virginia taxes if you qualify to use it, but there are a few additional rules to be aware of:

1. Do not confuse this with the Virginia subtraction for Virginia National Guard Income – it is not the same subtraction.

2. You can’t use this subtraction on income that is already not taxable – such as if your income was not subject to taxation because of the combat zone tax exclusion.

3. If you claim this subtraction you cannot also claim the Virginia Credit for Low-Income Individuals or the Virginia Earned Income Credit.

4. You do not need to be stationed inside Virginia to claim this subtraction.

The Wrong Way to Apply This Subtraction

I will sometimes see this subtraction incorrectly used by someone to remove a military member’s income from a jointly filed Virginia tax return because the spouse is required to file in Virginia, but the military member is not. They file their federal return jointly, and their software automatically prepares a joint Virginia return with both spouses on it. They realize the military member’s salary is not taxable in Virginia, so they use the military basic pay subtraction to remove it from the joint Virginia return. That’s not the right way to file, and will likely get you some letters from Virginia asking you for more money.

If one spouse has to file in Virginia, but the other does not, the correct method is to create a married filing separately return for Virginia and only include the income and deductions for the spouse required to file. I think by the time people get to that point in the tax prep process they are getting a little anxious to wrap it up and start looking for short cuts. Don’t try that one, though. Virginia will ‘fix it’ by adding the military member’s income back into the return and sending you a bill for the taxes on it. Then you end up paying someone like me to fix it for you.

If you are filing your own Virginia tax return, use code 38 when claiming the Military Basic Pay Subtraction. If you have any questions, please contact me!